Discover how the sudden Bloomberg Terminal outage disrupted global financial markets, delayed major bond auctions, and exposed the industry’s deep reliance on a single platform. Learn the causes, impact, expert reactions, and lessons for future resilience.

Table of Contents

- Introduction: The Day Finance Stood Still

- What Is the Bloomberg Terminal?

- Timeline of the Outage

- Immediate Impact: Markets in Limbo

- Global Ripple Effects: Auctions Delayed, Traders Paralyzed

- Expert Reactions: Industry Voices on the Outage

- Why the Outage Happened: Technical Insights

- The Hidden Risks of Market Concentration

- Business Continuity: How Firms Coped

- Lessons Learned and the Road Ahead

- Conclusion: A Wake-Up Call for Global Finance

- Frequently Asked Questions

Introduction: The Day Finance Stood Still

On the morning of May 21, 2025, the unthinkable happened: Bloomberg Terminals, the lifeblood of the global financial industry, went dark. For nearly two hours, traders, bankers, and asset managers worldwide found themselves cut off from the real-time data, analytics, and communication tools they rely on to make billion-dollar decisions. The outage sent shockwaves through bond markets, delayed high-stakes auctions, and exposed the vulnerabilities of an industry built on a single point of failure.

What Is the Bloomberg Terminal?

The Bloomberg Terminal is not just another software platform—it’s the gold standard for financial professionals. At a hefty price tag of $24,000 to $28,000 per user per year, it offers:

- Real-time market data on stocks, bonds, currencies, and commodities

- Advanced analytics and charting tools

- Direct messaging and chat between market participants

- Execution and trading capabilities

- News feeds from leading financial news agencies

With over 320,000 terminals installed in the world’s financial centers, Bloomberg is the nerve center of global markets.

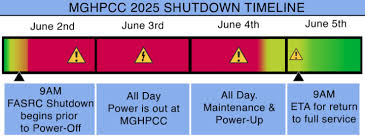

Timeline of the Outage

- Early Morning, May 21, 2025:

Traders across Europe and other regions report blank screens and unresponsive terminals. Only the chat function remains operational for some users. - Auction Delays Announced:

The UK Debt Management Office extends the bidding window for its 4% 2031 gilt auction. The European Union and Sweden also postpone bond sales due to the disruption. - Mid-Morning:

Some users begin to regain limited functionality, but full service is not restored for nearly two hours. - Late Morning:

Bloomberg issues a statement confirming that systems are “returning to normal operations” and apologizes for the disruption.

Immediate Impact: Markets in Limbo

The outage’s timing was critical. While it occurred on a relatively quiet trading day, the consequences were immediate and severe:

- Live pricing and market data vanished, leaving traders unable to value assets or execute trades confidently.

- Government bond auctions were delayed in the UK, EU, Portugal, and Sweden, affecting sovereign debt markets and investor confidence.

- Traders described the situation as a “nightmare”, with many left “sitting on their hands,” unable to act.

“You can’t load anything new, you can’t update spreadsheets, some of the auctions have been delayed.”

— Peter Schaffrik, Chief European Macro Strategist, RBC

Global Ripple Effects: Auctions Delayed, Traders Paralyzed

Major Auctions Affected

| Country | Auction/Instrument | Delay/Impact |

|---|---|---|

| United Kingdom | 4% 2031 Gilt Auction | Bidding window extended by 1.5 hours |

| European Union | EU Bonds | Deadline postponed by 1 hour |

| Portugal | Treasury Bill Auction | Delayed |

| Sweden | Government Bond Auction | Delayed due to technical issues |

Market Participant Reactions

- Banks and asset managers scrambled to implement backup plans, relying on alternative platforms like MarketAxess and Tradeweb, but these lacked the full functionality of Bloomberg.

- Some traders managed to continue streaming prices, but many were left in the dark, highlighting the industry’s dependence on a single provider.

Expert Reactions: Industry Voices on the Outage

Financial professionals were quick to acknowledge both the seriousness of the incident and the lessons learned:

- Eric Boess, Allianz Global Investors:

“Everybody was impacted and this just shows you how reliant on a small number of providers the whole industry is… This could be a real problem in busy markets.” - Dimitri Mongeot, AXA IM:

“There was indeed an outage, and as usual when that happens, it’s an issue for all buy sides and sell sides. In our case, it’s more of a quiet day, so on the derivatives part it was fine.” - Mark Grant, Southwest Securities:

“If Bloomberg doesn’t function, there’s a lot of the investment banks and institutions that are cut off… You really could disrupt—in a serious manner—the world’s financial markets.”

Why the Outage Happened: Technical Insights

While Bloomberg’s official response was limited, similar past incidents offer clues:

- Internal Network Issues:

Previous outages were caused by a combination of hardware and software failures that overwhelmed internal networks, leading to excessive traffic and customer disconnections. - No Evidence of Cyberattack:

In past statements, Bloomberg has emphasized that such incidents were not the result of external attacks but internal technical problems. - Restoration Efforts:

The company’s IT teams worked rapidly to restore service, but the incident highlighted the difficulty of troubleshooting and fixing issues in a system of such global scale.

The Hidden Risks of Market Concentration

The outage exposed a critical vulnerability: the global financial system’s reliance on a handful of technology providers. With Bloomberg dominating the market for real-time financial data and trading infrastructure, even a brief disruption can have outsized consequences.

Key Risks

- Single Point of Failure:

When one provider goes down, entire markets can grind to a halt. - Lack of Redundancy:

Alternative platforms exist but do not offer the same breadth or depth of data and analytics. - Operational Risk:

Firms must now reassess their business continuity and disaster recovery plans to account for such scenarios.

Business Continuity: How Firms Coped

Despite the disruption, many financial institutions demonstrated resilience:

- Backup Systems Activated:

Firms with robust business continuity plans quickly switched to alternative data sources and trading platforms. - Communication Channels:

The Bloomberg chat function remained operational for some, allowing limited coordination among market participants. - Real-World “Fire Drill”:

Some traders described the incident as a valuable test of their emergency procedures, which “worked super smoothly” for those prepared.

“With some gallows humor, this was a real-life fire drill we passed well.”

— Eric Boess, Allianz Global Investors

Lessons Learned and the Road Ahead

The Bloomberg Terminal outage is a wake-up call for the entire financial industry. Key takeaways include:

- Diversify Technology Providers:

Relying on a single vendor for critical infrastructure is a systemic risk. - Strengthen Business Continuity Planning:

Regular testing and updating of backup systems are essential. - Improve Transparency:

Vendors must communicate clearly and swiftly during incidents to help clients make informed decisions. - Regulatory Scrutiny:

Regulators may push for greater oversight of technology providers deemed “systemically important” to financial markets.

Conclusion: A Wake-Up Call for Global Finance

The Bloomberg Terminal outage of May 21, 2025, was more than a technical glitch—it was a stark reminder of the fragility and interconnectedness of modern financial markets. While the disruption was brief and occurred on a relatively quiet day, it exposed vulnerabilities that could have far more severe consequences in times of market stress. As the industry moves forward, resilience, diversification, and preparedness must become top priorities for everyone who relies on the digital arteries of global finance.

Frequently Asked Questions

Q: How long did the Bloomberg Terminal outage last?

A: The outage lasted for nearly two hours, with most users regaining full functionality by late morning.

Q: Which markets were most affected?

A: The outage disrupted government bond auctions in the UK, EU, Portugal, and Sweden, and affected traders worldwide.

Q: Was the outage caused by a cyberattack?

A: There is no evidence of a cyberattack. Past incidents were attributed to internal network issues.

Q: How much does a Bloomberg Terminal cost?

A: The annual subscription ranges from $24,000 to $28,000 per user.

Q: What steps can firms take to avoid similar disruptions?

A: Firms should diversify their technology providers, strengthen business continuity plans, and regularly test backup systems.

Powerful, timely, and essential—understanding the Bloomberg Terminal outage is crucial for anyone invested in the future of global finance.